milwaukee county wi sales tax rate

776 rows Waushara County. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06.

Wisconsin Sales Tax Small Business Guide Truic

The Milwaukee County sales tax rate is.

. Wells Street Room 507 Milwaukee WI 53202 Monday - Friday 800 AM - 445 PM. News Events CALL for Action. What is the sales tax rate.

Richmond Virginia had a 53 percent rate until October 1 2020 when the Central Virginia region became the states third region subject to the 07 percent regional state tax. The sales tax rate does not vary based on zip code. As for zip codes there are around 46 of them.

The most populous location in Milwaukee County Wisconsin is Milwaukee. My Tax Account - The departments online filing and payment system for businesses. The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital.

How to Compare. Milwaukee County Sales Tax Rates for 2022. What is the sales tax rate.

E-file Transmission - Filers transmit. This rate includes any state county city and local sales taxes. Sales Telefile - File and pay your sales tax with any touch-tone telephone by calling 608 261-5340 or 414 227-3895.

Milwaukee County is located in Wisconsin and contains around 8 cities towns and other locations. The current total local sales tax rate in Milwaukee County WI is 5500. Click on any city name for the applicable local sales tax rates.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. If this rate has been updated locally please contact us and we will update the sales tax rate for Milwaukee County Wisconsin. The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc.

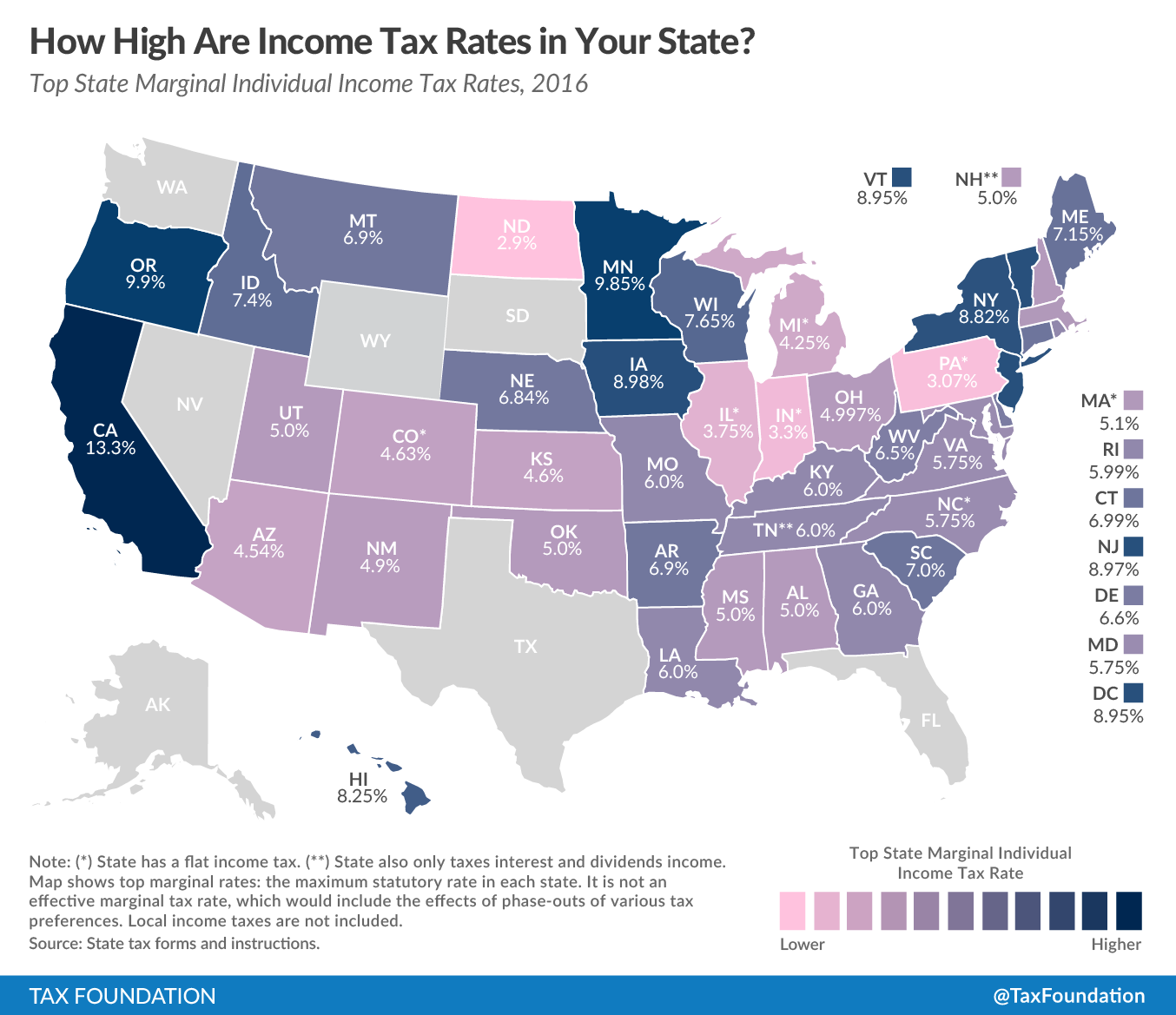

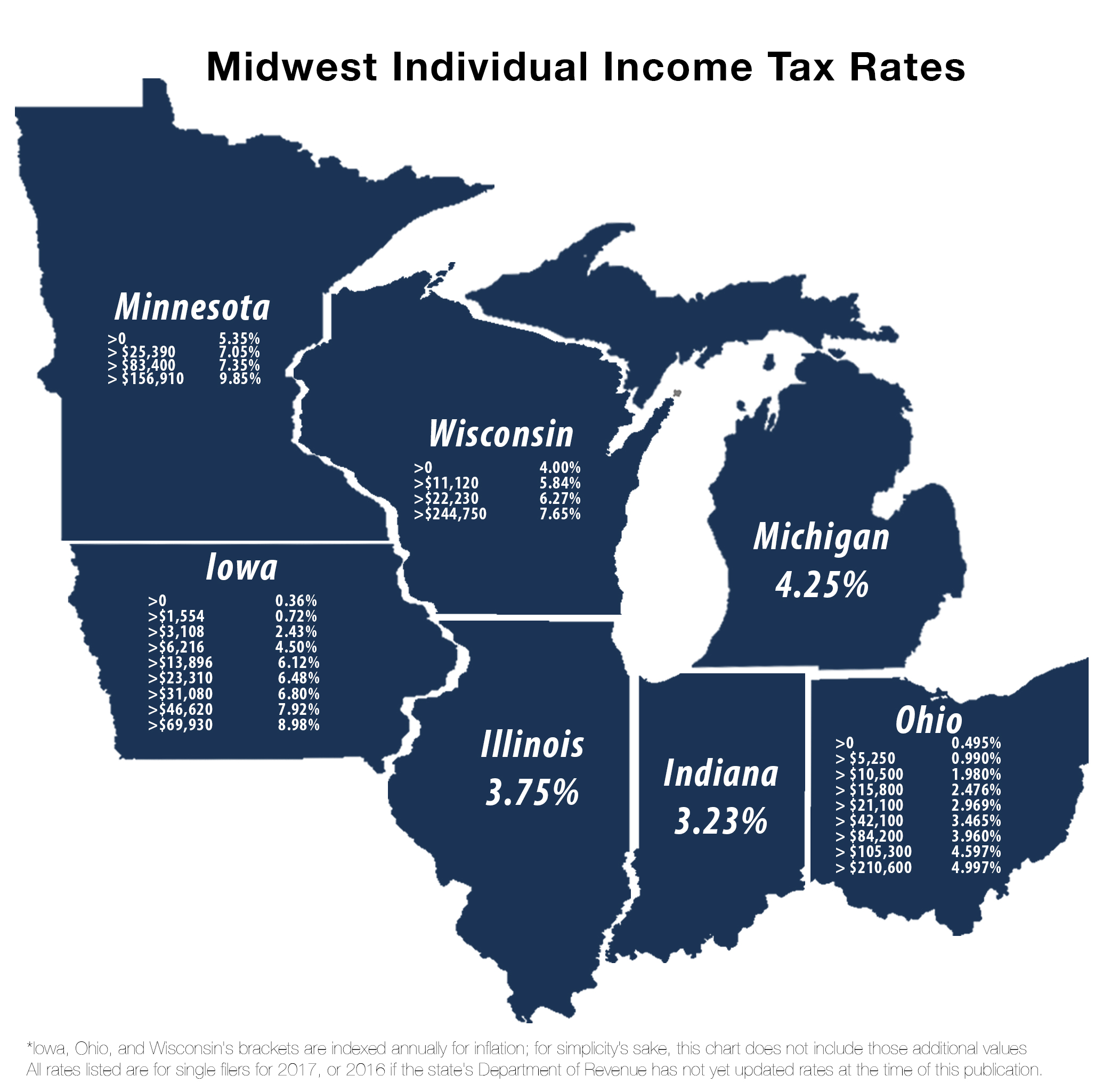

The total sales tax rate in any given location can be broken down into state county city and special district rates. Local tax rates in Wisconsin range from 0 to 06 making the sales tax range in Wisconsin 5 to 56. The latest sales tax rate for Milwaukee WI.

Milwaukee is located within Milwaukee County Wisconsin. Find Wisconsin State and County Sales Tax Rate for a particular sale. Milwaukee Health Department Coronavirus COVID-19 updates.

Automating sales tax compliance can help your business keep compliant with changing. What is the sales tax rate in Milwaukee Wisconsin. Additional information about these taxes is contained in.

The program is open to individuals and families who live in Wisconsin with overdue housing-related bills both with and without a mortgage who meet income and other eligibility. Wisconsin Help for Homeowners Wisconsin Help for Homeowners WHH is a new statewide program that can help with overdue bills like mortgage payments property taxes utilities and more. A full list of these can be found below.

The current Milwaukee County sales tax rate is 56 percent. The minimum combined 2022 sales tax rate for Milwaukee Wisconsin is. The 2018 United States Supreme Court decision in South Dakota v.

The average cumulative sales tax rate in Milwaukee Wisconsin is 55. To review the rules in Wisconsin visit our state-by-state guide. If you need access to a database of all Wisconsin local sales tax rates visit the sales tax data page.

Milwaukee County Treasurers Office. Milwaukee County is home to over 950000 people living in one of 19 communities which range in size from the City of Milwaukee with 595000 residents to the Village of River Hills with roughly 1600 residents. The current total local sales tax rate in Milwaukee.

Verification and processing of claims takes four to eight weeks. Milwaukee county property tax rates by city. Within Milwaukee there are around 39 zip codes with the most populous zip code being 53215.

2018 Brown County adopted the county sales tax. You can find more tax rates and allowances for Milwaukee County and Wisconsin in the 2022 Wisconsin Tax Tables. WI Sales Tax Rate.

Foreclosed Properties for Sale. Wisconsin City and Locality Sales Taxes. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06.

For assistance please call the MHD COVID Hotline 414-286-6800. This table shows the total sales tax rates for all cities and towns in. 9th St Room 102.

Find your Wisconsin combined state and local tax rate. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06. Wisconsin has a 5 sales tax and Milwaukee County collects an additional 05 so the minimum sales tax rate in Milwaukee County is 55 not including any city or special district taxes.

A full list of these can be found below. Access search engines showing delinquent taxes special improvement bonds tax accounts and tax data. This is the total of state county and city sales tax rates.

The base state sales tax rate in Wisconsin is 5. Has impacted many state nexus laws and sales tax collection requirements. Wisconsin sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The December 2020 total local sales tax rate was 5600. To review the rules in Wisconsin visit our state-by-state guide. The Treasurers office will contact the claimants to inform them when their claim is completed.

2020 rates included for use while preparing your income tax deduction. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Milwaukee County in Wisconsin has a tax rate of 56 for 2022 this includes the Wisconsin Sales Tax Rate of 5 and Local Sales Tax Rates in Milwaukee County totaling 06.

Cities or towns marked with an have a local city-level sales tax potentially in addition to additional local government sales taxes. The average cumulative sales tax rate between all of them is 55. The sales tax rate for Milwaukee County was updated for the 2020 tax year this is the current sales tax rate we are using in the Milwaukee County Wisconsin Sales Tax Comparison Calculator for 202223.

This includes the rates on the state county city and special levels.

Wisconsin Property Tax Calculator Smartasset

North Central Illinois Economic Development Corporation Property Taxes

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Wisconsin Sales Tax Rates By City County 2022

Which Cities And States Have The Highest Sales Tax Rates Taxjar

A Glide Path To A 3 Percent Flat Income Tax Maciver Institute

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Taxes In The United States Wikiwand

Revenue Wisconsin Budget Project

A Glide Path To A 3 Percent Flat Income Tax Maciver Institute

Wisconsin Sales Use Tax Guide Avalara

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation